- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Do Wall Street Analysts Like Solventum Stock?

/Solventum%20Corp%20logo%20on%20phone-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

With a market cap of $12.4 billion, Solventum Corporation (SOLV) is an independent healthcare company that develops, manufactures, and markets innovative solutions to meet critical patient and customer needs worldwide. Its business spans four segments: Medsurg; Dental Solutions; Health Information Systems; and Purification and Filtration, serving healthcare providers through direct sales, distribution, and digital platforms.

Shares of the Maplewood, Minnesota-based company have outperformed the broader market over the past 52 weeks. SOLV stock has increased 21.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.4%. However, shares of the company have risen 8.1% on a YTD basis, lagging behind SPX's 9.7% return.

Looking closer, Solventum stock has also outpaced the Health Care Select Sector SPDR Fund's (XLV) 10.8% decrease over the past 52 weeks.

Shares of Solventum rose 2% on Aug. 7 after the company reported Q2 2025 adjusted EPS of $1.69 and revenue of $2.2 billion, above Wall Street forecasts. Growth was driven largely by its MedSurg segment, where sales rose 4.8% to $1.2 billion, reflecting robust demand for wound care and surgical sterilization products, alongside lower expenses. Additionally, management raised its full-year adjusted EPS guidance to $5.80 - $5.95, as easing U.S.-China tariff risks reduced expected headwinds.

For the fiscal year ending in December 2025, analysts expect SOLV’s adjusted EPS to decline 11.9% year-over-year to $5.90. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

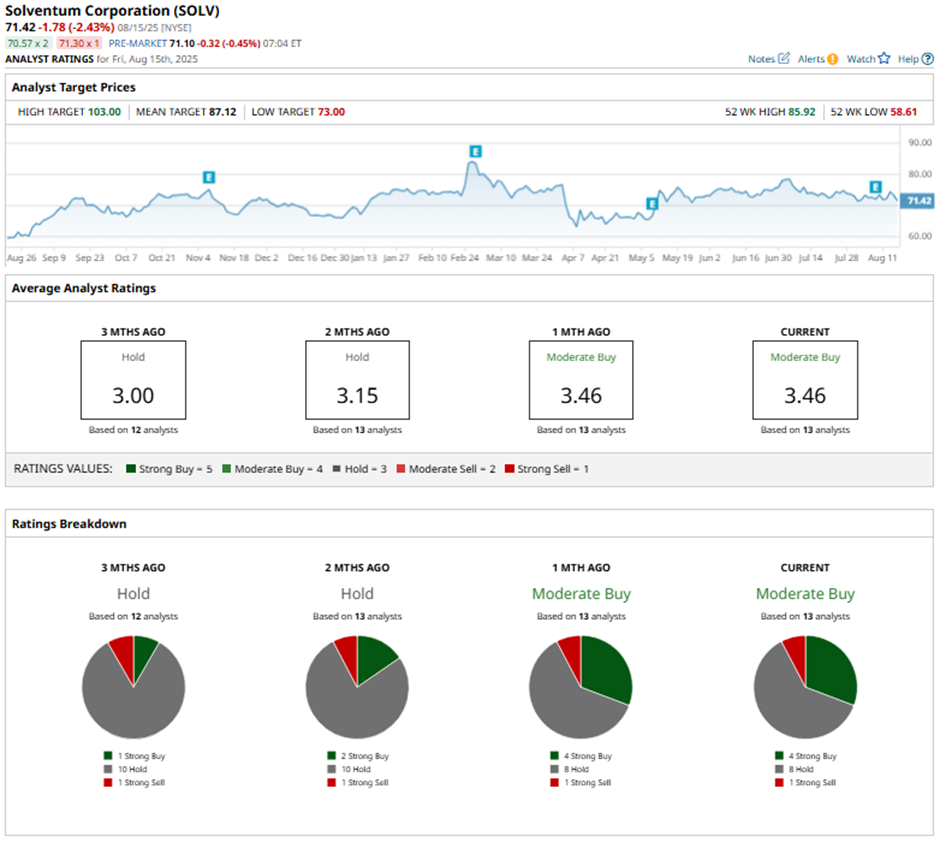

Among the 13 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, eight “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with one “Strong Buy” rating on the stock.

On Aug. 8, Piper Sandler increased its price target on Solventum to $94 while maintaining an “Overweight” rating.

As of writing, the stock is trading below the mean price target of $87.12. The Street-high price target of $103 implies a modest potential upside of 44.2% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.