- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

PulteGroup Stock: Is Wall Street Bullish or Bearish?

/PulteGroup%20Inc%20phone%20and%20lapton%20by-%20rafapress%20via%20Shutterstock.jpg)

Atlanta, Georgia-based PulteGroup, Inc. (PHM) engages in the homebuilding business. Valued at $25.4 billion by market cap, the company sells and constructs homes, and purchases, develops, and sells residential land and develops active adult communities. PHM also provides mortgage financing, title insurance, and other services to home buyers.

Shares of this homebuilding giant have underperformed the broader market over the past year. PHM has gained 5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.4%. However, in 2025, PHM stock is up 18.2%, surpassing the SPX’s 9.7% rise on a YTD basis.

Narrowing the focus, PHM’s underperformance is also apparent compared to the SPDR S&P Homebuilders ETF (XHB). The exchange-traded fund has gained about 2.1% over the past year. However, PHM’s double-digit gains on a YTD basis outshine the ETF’s 8.5% returns over the same time frame.

PulteGroup is underperforming amid challenges in the housing industry, including high interest rates and unaffordable home prices. Despite strong demand for homeownership, sales have slumped due to economic uncertainty and rising borrowing costs.

On Jul. 22, PHM shares closed up more than 11% after reporting its Q2 results. Its EPS of $3.03 surpassed Wall Street expectations of $2.92. The company’s revenue was $4.40 billion, topping Wall Street forecasts of $4.37 billion.

For the current fiscal year, ending in December, analysts expect PHM’s EPS to decline 14.6% to $11.34 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

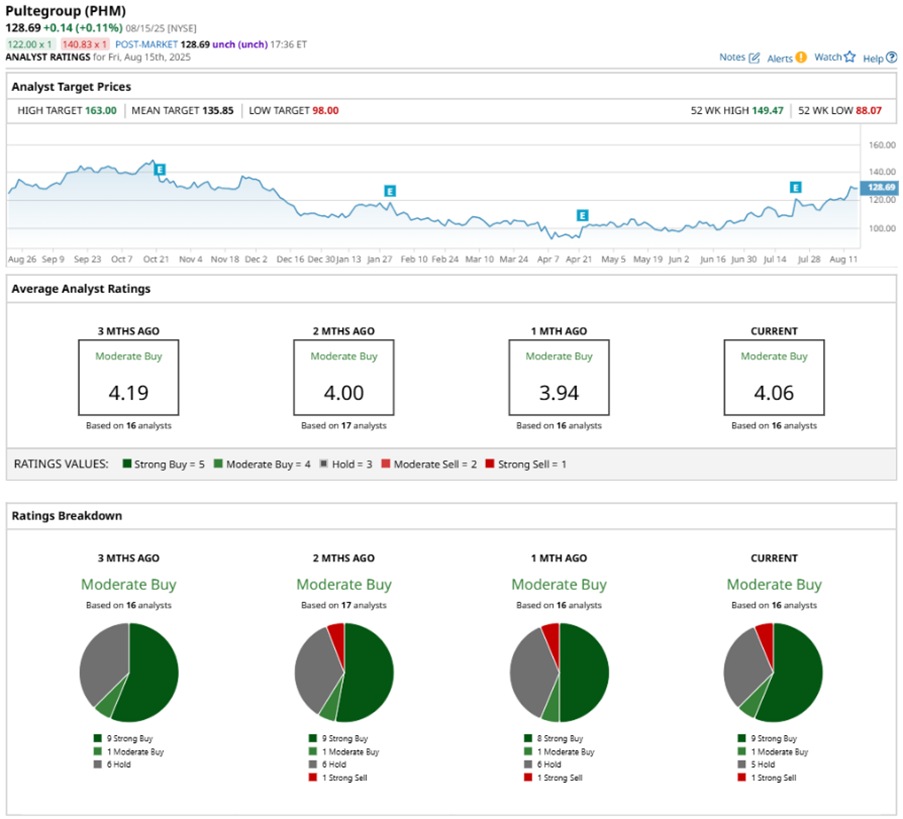

Among the 16 analysts covering PHM stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” five “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Jul. 23, JPMorgan Chase & Co. (JPM) analyst Michael Rehaut maintained a “Buy” rating on PHM and set a price target of $123.

The mean price target of $135.85 represents a 5.6% premium to PHM’s current price levels. The Street-high price target of $163 suggests an ambitious upside potential of 26.7%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.