- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

U.S. Dollar Dominance Unleashed: Are You In or Out?

The U.S. dollar is riding a wave of bullish momentum, underpinned by several economic and geopolitical factors. A revised Q2 GDP growth rate of 3.8%, the strongest in nearly two years, reflects vigorous consumer spending, signaling economic resilience that bolsters the dollar's appeal. Additionally, initial jobless claims dropped to their lowest level since mid-July, pointing to a sturdy labor market despite broader uncertainties. The ongoing U.S. government shutdown has paused the release of jobs data, conveniently shifting attention away from any potential labor market softening that could have pressured the dollar. On the global stage, France has experienced genuine political instability in 2024 and 2025 following President Macron's decision to call a snap election in 2024, which led to a hung parliament. The resulting political gridlock has led to the resignation of multiple prime ministers and concern from economists. This instability has negatively impacted the euro's value and driven some investors to seek the comparative safety of the U.S. dollar. Japan faces political uncertainty after its ruling coalition lost its parliamentary majority in late 2024. This has led to fears of legislative gridlock and the government's ability to address key economic challenges, contributing to yen volatility. This has contributed to a weakened yen, which is often seen as a traditional safe-haven currency, and strengthened the U.S. dollar. The continuation of the 2022 Russia-Ukraine conflict continues to drive investors towards the safety of the U.S. dollar and improve its value, especially against European currencies. Investors still perceive the U.S. economy as more insulated from the direct effects of the war than Europe's. The U.S. stock market may benefit as dollars are repatriated to the U.S.

However, traders should remain cautious, as headwinds loom on the horizon. Expectations of Federal Reserve rate cuts, aligning with moves by other major central banks, have tempered the dollar's gains for the majority of 2025, signaling potential softening ahead. With imports outpacing exports, the persistent U.S. trade deficit challenges the dollar's long-term value. Additionally, the government shutdown introduces economic uncertainty that could eventually erode confidence if prolonged. Compounding these concerns, inflation remains stubbornly above the Fed's 2% target, eroding the dollar's purchasing power and reminding investors that while the near-term outlook is favorable, vulnerabilities warrant close monitoring.

Technical Picture

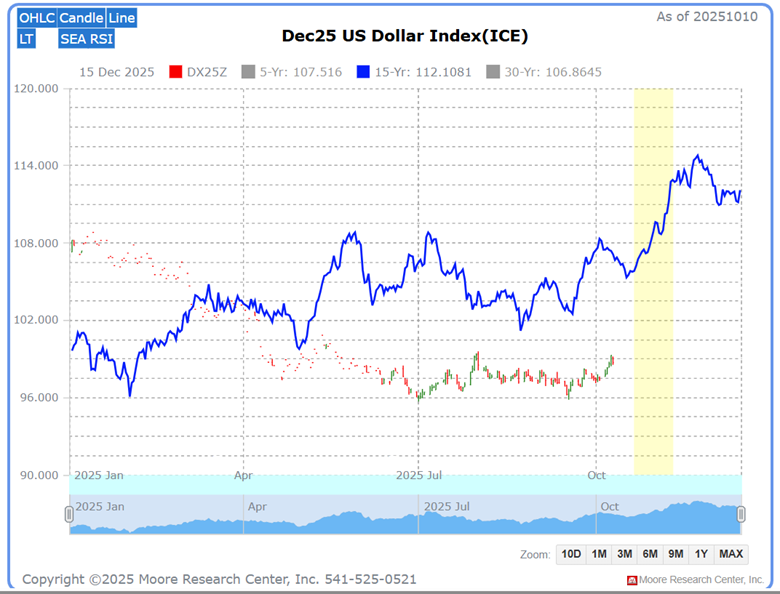

Source: Barchart

Technically, the daily nearby U.S. Dollar futures have been basing after their significant 2025 selloff. The 50 simple moving average (SMA) has been trading flat. The bears tried pressing the dollar below their July 2025 lows in September, but failed to breakout and have now rotated back towards the upper end of the channel. The failed breakout to the downside in September has set up a possible bullish double bottom pattern. If the bulls can get some trading activity above August highs, the measure move would place the U.S. dollar futures near the 104 handle. A break above the August highs could be enough to pull the 50 SMA upward and be bullish for later corrections.

Seasonal Pattern

An upcoming U.S. dollar seasonal buying pattern supports the potential bullish technical picture. Moore Research Center, Inc. (MRCI) research has found that the dollar historically gains upward momentum into the calendar year-end. Interest rate products also have a seasonal tendency to decline (higher rates) in the same period. However, this year, interest rate products are trending higher (lower yields), which could remove some dollar support. Traders should continue monitoring interest rate products if they trade a bullish U.S. dollar.

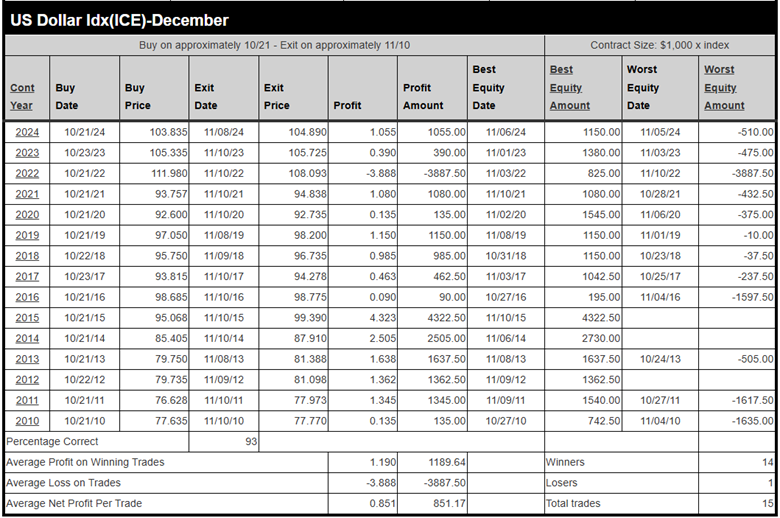

Source: MRCI

The 15-year seasonal pattern (blue line) commonly found a bottom in prices near September and climbed into the year-end. MRCI's continued research has enhanced a seasonal window (yellow box) that has seen the U.S. dollar close higher on approximately November 11 than on about October 21 for 14 of these 15 years, a 93% occurrence rate. Hypothetical testing has found that 3 of the 15 years never had a daily closing drawdown. The seasonal buy window is open for about 21 calendar days. This allows traders to manage a position from start to end or manage multiple bullish in and out trades during the seasonal window.

Source: MRCI

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider various technical and fundamental indicators, risk management strategies, and market conditions to make informed and balanced trading decisions.

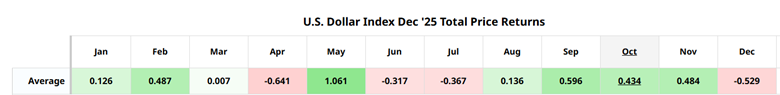

Source: Barchart Seasonality

Barchart's 15 seasonal pattern reflects the August to November expansion in the U.S. dollar.

Assets for Traders to Participate

The bullish U.S. dollar seasonal pattern can be traded through various financial products. Traders can participate by buying U.S. dollar-based instruments such as the U.S. Dollar Index (DXY) futures or options listed on the Intercontinental Exchange (ICE), which track the dollar's value against a basket of major currencies. To capitalize on this trend while betting against the euro, which often moves inversely to the dollar, traders can sell (short) euro futures or buy put options on the euro through currency pairs like EUR/USD on forex markets or exchange-traded products. Options on the ICE Dollar Index or EUR/USD pair allow traders to leverage the dollar's seasonal strength with defined risk, enabling strategies like buying call options on the DXY or put options on the euro to profit from the expected inverse relationship during the bullish dollar period.

In Closing…

A potent mix of economic indicators, global uncertainties, and a reliable seasonal pattern drives the U.S. dollar's bullish momentum in late 2025. Strong Q2 GDP growth of 3.8%, a resilient labor market, and the U.S.'s relative insulation from geopolitical turmoil—like France's political gridlock, Japan's legislative challenges, and the ongoing Russia-Ukraine conflict—have bolstered the dollar's safe-haven appeal, particularly against a weakened euro and yen. The seasonal window, highlighted by Moore Research Center's data, shows a 93% historical tendency for the dollar to rise from mid-October to early November, supported by technical patterns like a potential bullish double bottom in U.S. Dollar Index futures. Traders can capitalize on this through DXY futures, options, or by shorting the euro via EUR/USD pairs, though they must remain vigilant. Persistent inflation, a looming trade deficit, and potential Federal Reserve rate cuts signal headwinds that could temper gains. By blending technical analysis, risk management, and awareness of global and seasonal dynamics, traders can navigate this bullish dollar phase with informed precision.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.